“The biggest hindrance to our success is our own government.”

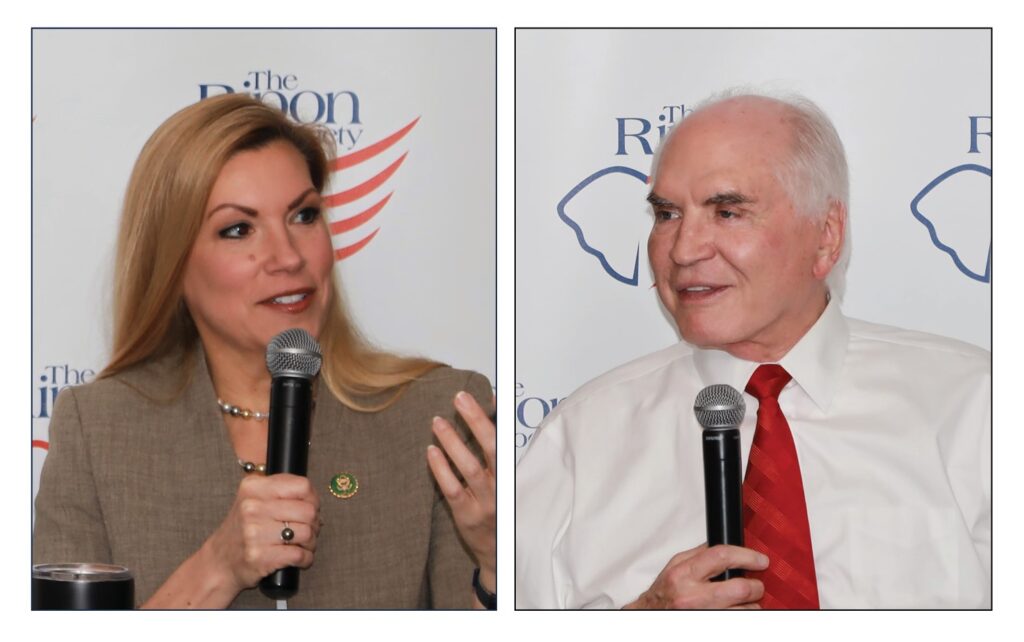

WASHINGTON, DC – With the U.S. economy continuing to face headwinds, The Ripon Society held a breakfast discussion Wednesday morning with U.S. Reps. Mike Kelly (PA-16) and Beth Van Duyne (TX-24) who both serve on the Ways and Means Subcommittee on Tax, to discuss the Subcommittee’s efforts to keep the tax burden low and make sure our tax system strengthens American competitiveness both here at home and around the world.

Kelly, who owns and operates an auto dealership that employs more than 100 people in his western Pennsylvania district, serves as Chair of the Subcommittee. He kicked off his remarks by commending the makeup of both his party and the Committee and highlighted the importance of real-life experience when drafting policy.

“When you look at our committee, we have so much responsibility. It’s not power, it’s responsibility, and jurisdiction in so many different ways. I look at the Republican party and the diversity, it has everything to do with talent. And we are knee deep in talent, and we are knee deep in people that have actually walked the walk before they talk the talk. They have actually been through it. Their life has not been easy. They have faced every challenge they have, and they have survived. That’s who you want here. That’s who we need here. Being able to go through the hardest times and sometimes face payroll where you’re able to pay everybody on payroll, but not yourself. You have to go through those things before you can make policy.”

Van Duyne followed the Chairman’s remarks and described her work as a member of the Irving, TX city council and how it led to her election to mayor, having to choose what was best for her city even if the decision was not popular.

“When I was on the city council, if there was one vote that was against what the rest were doing, it was mine. I will tell you — I don’t mind standing on my own for what I believe in, and it has never hurt me politically.”

Van Duyne continued to share the valuable insight she has gained from connecting with the people she represents over the years in both local and federal aspects, including an example she shared from an international company based in Irving that has business in Europe and Asia.

“Some of the trade issues that they’re having with Mexico, trade issues that they’re having with Turkey, and how the U.S., our government, is actually working against businesses that we are favoring, not having us be globally competitive, but we’re favoring what’s going on overseas because we put all of these straps of regulations and taxes and burdens on our domestic companies and totally let international companies that do business with us go Scott free.”

The Lone Star State lawmaker credited her inside knowledge to personal connections she has developed over the years.

“How do you learn that? It’s nothing that you are going to pick up from the paper. According to most media, businesses are bad, right?

“You’re not going to read about it, but how do you find out about it? Talking to people. What I’ve been hearing is, ‘Why are you trapping us?’ Some of the focuses that I have, include working on our businesses and investing in that dream, recognizing that in Irving, for example, three-quarters of our tax base was paid for by our businesses.”

Van Duyne highlighted the success the state has seen due to its pro-business approach to taxes, specifically a recent report showcasing 26 consecutive months of job growth.

“Why did we have one of the largest growing and fastest-growing communities in the country? Because we recognize that regulations strangle. We recognize that you have to have a positive working relationship.”

When asked about the goals and priorities of the powerful Ways and Means Committee in the 118th Congress, Rep. Kelly gave a positive forecast for the coming months.

“I don’t know that there’s anybody harder working than Jason Smith (MO-08). One of the things that I think Jason has done is that he really brings the government to America. What Jason’s trying to do and what he’s done so, so well is to take Washington to America and show people that we actually understand what it is that they’re going through.”

Later, when asked about the hindrances loaded onto American businesses from our own government as well as European legislators, Rep. Van Duyne laid out the blueprint on how to combat the increasing burdens on American enterprise.

“One, we can continue to point it out. Two, we can hold these agencies accountable because they have gotten completely out of control. Three, we can focus on passing policies that actually help.

“Policies matter. Making sure that we’re on the same page. Our Limit, Save, Grow, Act was one example of positive policy. Holding the line and working together as a team is going to have to be front and center.”

When asked what can be expected in the debt ceiling dealings and future tax legislation packages, Kelly continued to foreshadow the work of the Committee and shared his personal passion for protecting the American taxpayer from the overreaching powers of the IRS.

“When we talk tax policy, there’s very few people in business that do their own taxes and why don’t they do that? Well, it’s complicated, but it’s also fear of the most powerful agency in our government coming in and taking over.”

Kelly has introduced a number of bills this Congress to address federal overreach by the IRS through bills such as the IRS Funding Accountability Act and the Prohibiting IRS Financial Surveillance Act.

“With the IRS, if you’ve not been through these things, if you’ve not had them come in and completely disrupt your business model because they come first on everything, they pull people who are productive off a job to come in and find out. This stuff is so intrusive and this government has grown so big and so powerful.”

In his closing remarks, Kelly reminded The Society that the government – especially the executive branch – has got to get their spending of taxpayer dollars under control.

“The biggest hindrance to our success is our own government at the federal level, at the state level, at the local level. And they’re insatiable in this appetite of spending money.”

To view the remarks of Kelly and Van Duyne at Wednesday’s breakfast discussion, please click the link below:

The Ripon Society is a public policy organization that was founded in 1962 and takes its name from the town where the Republican Party was born in 1854 – Ripon, Wisconsin. One of the main goals of The Ripon Society is to promote the ideas and principles that have made America great and contributed to the GOP’s success. These ideas include keeping our nation secure, keeping taxes low and having a federal government that is smaller, smarter and more accountable to the people.