Major rewrites of the U.S. tax code occur once in a generation, yet in 2025 Congress and the White House are presented with an unusual opportunity to revisit America’s tax policies as large parts of the 2017 Tax Cuts & Jobs Act expire at the end of that year.

For perspective, the need for a modern, pro-growth tax code had grown in urgency ahead of the 2017 effort. For example, America’s corporate tax rate had fallen to among the worst in the world and dead last among our main foreign competitors.

As a result economic growth was slow, less than two percent, and paychecks were stagnant for a decade ahead of 2017. We regularly saw headquarters, manufacturing plants, and research facilities move overseas.

In 2025, a key decision will be whether to extend or make permanent key sections of the TCJA, including the current lower rates for individuals.

At the time, House leaders of the tax reform effort sought a new tax code “built for growth”: of jobs, paychecks, and the economy. They wanted a tax code that was simpler, fairer and lowered taxes for the many while eliminating special provisions for the few.

Middle Class Tax Cuts

In 2025, a key decision will be whether to extend or make permanent key sections of the TCJA, including the current lower rates for individuals. TCJA cut taxes for families across the board producing an average $2,000 tax cut for middle class families of four. It doubled the standard deduction and indexed it for inflation — which protects more of the first dollars workers earn and simplified the tax code so that a record 90 percent of taxpayers today file without itemizing their taxes. And it doubled the Child Tax Credit to $2,000, increased refundability, and expanded the income eligibility to millions more American families.

Small Businesses

Lawmakers must decide whether to extend the historic Small Business Tax Deduction of 20 percent for pass-through businesses created to help Main Street keep more of what they earn and invest it back in their businesses. The 2017 reform also allowed businesses of all sizes to immediately write off more of the cost of new equipment, machinery, and software that spurs productivity of their workers.

Economic Growth

Economic growth will be at the forefront of the 2025 debate. The TCJA lowered the corporate tax rate to 21 percent and modernized the international tax code so U.S. businesses can compete and win anywhere in the world, especially here at home. And when they succeed, they are no longer punished for bringing those profits home from overseas to be invested in America.

As a result, U.S. economic growth quickly accelerated to 3.3 percent and household income grew more in 2019 than in all eight years previously — combined. Poverty dropped to 50-year lows, especially for people of color, women, and the low-skilled. Income inequality began to shrink for the first time in half a century, and incentives for new U.S. investment played a major role in America quickly recovering from the Covid pandemic and its supply chain challenges.

Lawmakers in both parties should be cautious about raising the corporate tax rate — which does not expire in 2025 — to 28 percent as some propose. The current TCJA rate immediately drove higher capital investment into America, brought $1.5 trillion of stranded profits back to the U.S., and not a single U.S. headquarters has moved overseas since.

TCJA cut taxes for families across the board producing an average $2,000 tax cut for middle class families of four.

A 28 percent rate, coupled with state taxes, would drive America’s rate to the second highest among our Organization for Economic Cooperation and Development (OECD) competitors (higher than China), slow the U.S. economy, and shrink workers’ paychecks. This places America at a serious disadvantage as other countries are aggressively seeking our jobs, manufacturing, research, and intellectual property.

Lawmakers should heed the Treasury Department, Congressional Budget Office, and Joint Committee on Taxation, all of whom have determined that workers bear a significant portion of the corporate income tax — more than half according to some economists. Based on the Treasury’s own research, raising the corporate tax to 28 percent would impose a $500 billion tax increase on families making less than $300,000 a year. The burden is even heavier for families making less than $72,500, because the increase in the price of goods and services due to corporate taxes falls disproportionately on them.

Estate Tax, Deductions & International

Without Congressional action, the estate tax on family-owned farms and businesses returns to a punitive $5 million exemption amount per spouse — exposing them to a crushing 40 percent tax rate and forcing them to sell all or parts of their family farm or business to pay the IRS.

Many exclusions and deductions, including the state and local tax deduction, the Alternative Minimum Tax, the paid employer family and medical leave credit, and Opportunity Zones will also expire in 2025.

Congress will also wrestle with the international tax code which now faces new, complicated taxes levied by OECD competitors that will make America less competitive, impair existing bipartisan tax incentives, take a bite out of the U.S. tax base, and hamstring Congress’s ability to write tax policy in the future.

American lawmakers should control America’s tax policy – not our foreign competitors.

Much is at stake in 2025, with tax hikes that could top $4 trillion over the next decade. While the makeup of Congress and the White House remains unknown, lawmakers in both parties are wise to be working now to identify bipartisan tax priorities for 2025 that benefit American workers, families, job creators, and the economy.

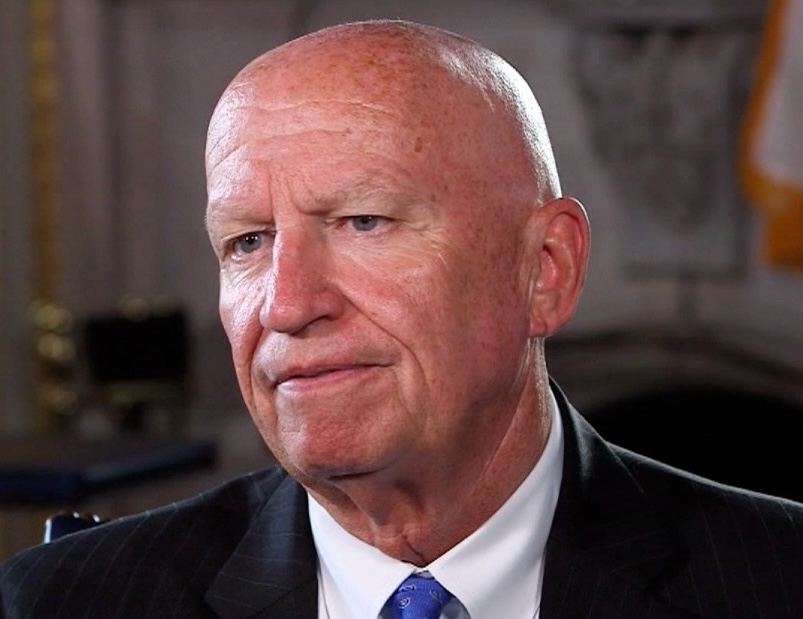

Kevin Brady represented the 8th Congressional District of Texas from 1997 to 2023 and served as Chairman of the House Ways and Means Committee from 2015 to 2019. As Chairman, he led the Committee’s effort to deliver a detailed blueprint for comprehensive, pro-growth tax reform, which resulted in passage of the 2017 Tax Cuts and Jobs Act.