The writer Thomas Friedman makes the argument that the most important competition today is between “you and your imagination.”

As much as football fans may have been led to believe it was between the Patriots and the Giants at the Super Bowl – or as much as people might believe in economic terms it is between America, China and India – Friedman argues otherwise. He believes energetic, innovative and connected individuals can now act on their imaginations farther, faster, deeper and cheaper than ever before. He also contends those countries and companies that empower their individuals to imagine and act quickly on their imagination are going to thrive.

In short, ideas matter, and about the time you come up with a good one someone else on the other side of the world is sure to do the same. Therefore, whoever acts first wins.

Are you really free to act, much less imagine ideas on which to act, as you are rooting around shoeboxes of receipts at tax time? I’d say no, and most would admit that acting as a clerk for the government during portions of the year does not represent one’s most creative time. Sadly, whatever creative energies are mustered generally go to tax avoidance rather than building things.

Liberating human creativity and therefore providing for long-term economic prosperity has led a number of policymakers in recent years to look closer at tax policy – in particular the ways in which lowering the income tax presents lasting economic benefits. A recent report by the Atlanta Federal Reserve Board stated that, “Relative marginal tax rates have a statistically significant negative relationship with relative state growth.” To translate that into everyday English: High income tax rates slow the growth of people’s paychecks and low rates raise them.

… 41 million Americans “voted with their feet” by moving out of high-tax states and into low-tax states over the last 15 years.

A quick look at the U.S. as a whole bears this out. A recent study by Richard Vedder, Professor of Economics at Ohio University, distinguished between nine “low-tax states” and a score of other “high-tax states.” Vedder found that 41 million Americans “voted with their feet” by moving out of high-tax states and into low-tax states over the last 15 years. They wanted more time out of the shoebox filled with receipts and more time in imagining, creating and implementing ideas — all foundational to wealth creation.

So I think we could rationally argue there are benefits tied to lowering marginal rates. The problem in the world of policy is not whether an idea is good or not, for there are scores of good ideas that go nowhere.

The question is how might you get it done?

From Pickett to Sun Tzu

For the last four years we have tried the “Pickett’s Charge” approach and advocated an abolition of the income tax.

Being straightforward fits my personality and our administration. And, as a result of this approach, we were able to get the first cut to the marginal rate in our state’s history – a cut from 7% to 5% for limited liability companies, partnerships and sole proprietorships. Unfortunately the head of the Senate Finance Committee in our state dug in his heels in going any further than this, and is dead set against what he calls “cutting rates for rich folks and losing money to help people.”

So we have been forced to take the sixth-century B.C. Chinese military strategist Sun Tzu’s counsel to pursue one’s aims with subtlety. For that reason, we recently proposed an optional “flat tax.”

It harnesses three thoughts. The first is the need to expand individual freedom, time and initiative in Friedman’s flat world. The second is the simplicity of a flat tax. And the third is an incredible push by a range of interest groups in our state to raise the cigarette tax.

Our proposal would simply allow an individual the choice to either pay taxes at the current 7% or forgo exemptions and pay 3.4%. The choice would be the taxpayers, and it allows you to avoid the endless debates that stall tax reform. In general most people like the idea of moving to a flat tax. But the general public does not drive the inner workings of the tax writing process. Those debates are driven by a long list of constituencies and businesses that lose or make money with each exemption in the code. I don’t begrudge the realtors, for example, for arguing in favor of home interest deductibility. But each one of these voices collectively heard make changes that would make our overall code more competitive impossible.

So our reform is premised on what all of America seems to want these days – a choice. From restaurants to magazines and media to the car you drive, we insist on an endless array of choices. Why should it be different in the tax code given our different stations and seasons in life, if it can be done in a way so that the haul to the government is all the same?

This is where the cigarette tax comes in, because rather than taking that money to grow government, we apply it to lowering the marginal rate. And since all taxes are not created equally, raising our lowest in the nation cigarette tax of 7 cents a pack by a relatively modest 30 cents to us seems good policy. This is particularly true in our instance since anything not revenue neutral is dead on arrival with the head of Senate Finance — and because of the way it prevents others from taking the cigarette money and growing government.

The Benefits of Reform

We believe the benefits of taking this course would be incredible. A 3.4% flat tax would mean that people in the top income bracket – in our case those making more than $12,850 per year, or almost everybody with a full-time job – could see their income tax rate cut by half. That kind of tax change could also lure entrepreneurs in search of better-tax environments to start businesses here. Seven other states have come to the same conclusion: Colorado, Illinois, Indiana, Massachusetts, Michigan, Pennsylvania, and Utah have each implemented a flat tax.

The case for a low flat tax is now being made literally all over the world. Since enacting a flat tax, Slovakia has seen foreign investment grow by 500%. Russia did the same and saw its revenue double. So did Estonia, which is now averaging 5% yearly growth.

In short, a lowered and flattened tax represents significant step towards making our economy more attractive, and in this debate it would be hard to improve on the words of Rhode Island House Speaker William Murphy – a Democrat. The goal of the flat tax, he said, “is to put more money directly in people’s pockets both by giving relief to those who need it and by making Rhode Island a more attractive place for business.”

Given the importance of human imagination, and the freedom necessary to see it flourish — not to mention the fact that we’re now competing against economies literally all over the world — the time to re-think our tax structure is now.

A closer look at the flat tax seems to me a great place to start because, in short, I believe the system that most effectively maximizes human freedom wins.

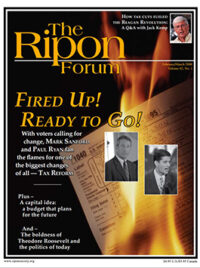

Mark Sanford is the Governor of South Carolina.