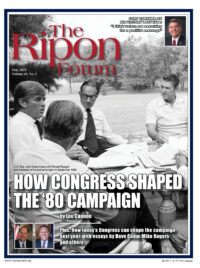

Elections focus on the real life concerns of the American people. For most Americans today, the strength of the US economy is a top concern. That was true in 1980 when Ronald Reagan made reducing tax rates to promote a stronger economy a central part of his campaign message. It remains true today when Americans are apprehensive about the lack of jobs and stagnant wages – wages that Americans depend on to pay their mortgage and put their children through school.

The current effort to advance meaningful tax reform is all about strengthening the U.S. economy, making US companies more competitive in the global marketplace, and making the tax code simpler and fairer for individuals. Just as the tax proposals of Rep. Jack Kemp and Senator Bill Roth contributed to President Reagan’s successful campaign, the current Republican-led Congress has an opportunity to have a significant impact on the 2016 elections with the tax reform effort underway in the House Ways and Means Committee and the Senate Finance Committee. The results of that effort could help shape the campaign for a Republican candidate to win the White House and for Republicans to increase their majorities in the House and the Senate.

The current Republican-led Congress has an opportunity to have a significant impact on the 2016 elections with the tax reform effort underway in the House Ways and Means Committee and the Senate Finance Committee.

Ways and Means Chairman Paul Ryan and Finance Chairman Orrin Hatch recently reaffirmed their commitment to comprehensive, revenue neutral tax reform to benefit families and businesses of all kinds. They said that because President Obama is unwilling to reduce individual statutory tax rates, some aspects of tax reform may have to be deferred until after the 2016 Presidential election. But in the meantime, they do not believe we wait until 2017 to take steps to promote a stronger US economy.

Accordingly, they are seeking to find common ground on business income tax reform, which will lower the US corporate tax rate – now the highest in the world – and provide effective tax rate relief for “pass-through” businesses whose owners are subject to the individual tax rates.

The narrowing of the scope of near-term tax reform efforts may well make legislative action this year more likely. In a recent joint letter, the two chairmen have asked taxpayers to submit tax reform ideas by May 31 of this year.

Chairman Ryan and Chairman Hatch are demonstrating to the American people that a Republican-led Congress will take action to strengthen the U.S. economy and to facilitate the creation of better paying jobs. Communicating to the general public these Republican initiatives, as well as explaining the benefits of tax reform, will help this become a winning Republican issue in advance of the 2016 elections.

In recent years, tax reform has progressed from just a handful of us talking about it, to one of the dominant issues being debated in Washington and around the country. Joining that debate have been a large number of coalitions representing job creators who understand the importance of more and better jobs at home and the need for the United States to compete in a global economy. In addition, numerous Congressional hearings, bipartisan working groups, discussion drafts, and white papers are serving to lay a solid foundation for tax reform. As Chairman of the Ways and Means Committee, I developed and released a comprehensive proposal to overhaul the tax code for the first time since 1986 that reflects the years of work undertaken on this critical issue.

Simplifying our complicated tax code and lowering the tax burden for both businesses and American families will spur job creation and improve the economic security of all Americans.

Chairman Ryan and Chairman Hatch are now continuing the effort to reform our tax code. While we don’t know whether they will complete the first phase of comprehensive tax reform in 2015, no one should doubt their commitment to the cause. A good sign of this can be seen in the Senate where Chairman Hatch and Ranking Member Ron Wyden have led Finance Committee members, both Republicans and Democrats, to discuss tax reform issues in bipartisan working groups, which is an approach I used very effectively in the House.

At the same time, Chairman Ryan and Chairman Hatch are sending a clear message that Republicans are committed to comprehensive tax reform that lowers tax rates for both companies and individuals. Simplifying our complicated tax code and lowering the tax burden for both businesses and American families will spur job creation and improve the economic security of all Americans. This is a positive message that a Republican presidential candidate can run on and win the White House in 2016, just as Ronald Reagan did in 1980.

Former House Ways and Means Chairman Dave Camp (R-MI) is currently a Senior Tax Policy Advisor to PricewaterhouseCoopers. The views expressed are his own and are not offered on behalf of PwC or any client of the firm.