Millions of taxpayers dodged a bullet when Congress in December finally passed a clean, one year “patch” on the exemption level for the Alternative Minimum Tax (AMT), though many of them may not know it. This eleventh-hour legislation was needed to protect middle-income taxpayers from the ever expanding reach of the AMT – an illegitimate tax that, if left unaddressed, would impose a stealth tax hike on numerous Americans.

Adjusting the poorly crafted AMT has become something of an annual tradition in Congress, and our perennial need to fix this element of our tax code suggests an even greater need: overall reform and simplification of the individual income tax system.

To get a sense of how our tax code has evolved into the behemoth it is today, consider how the AMT has changed over the years from a well intentioned policy to close loopholes into a growing burden on law abiding taxpayers.

Good Intentions Gone Astray

When the Alternative Minimum Tax was initiated in 1969 as an add-on to the existing tax code, its purpose was to prevent fewer than 200 wealthy taxpayers from using loopholes to avoid paying their legitimate tax obligations.

In contrast, the number of taxpayers subject to the AMT stood at approximately 3.5 million in 2006. Moreover, largely because the tax was never indexed for inflation, the AMT threatened to ensnare approximately 23 million taxpayers this income tax season if Congress had not passed corrective legislation.

Unfortunately, in last year’s politically charged environment, with the majority in the House of Representatives committed to a flawed version of pay as- you-go policy, even enacting a temporary AMT “fix” proved contentious. To his credit, the Chairman of the House Ways and Means Committee, Charlie Rangel, acknowledged the need for a permanent repeal of the AMT as well as a reduction in America’s corporate tax rate. Too bad his proposal – dubbed the “mother of all tax reform” – would raise other taxes by $3.5 trillion over 10 years, amounting to the largest individual income tax increase in U.S. history.

If this were allowed to occur, the federal government would end up consuming an ever-growing share of the American economy. Instead of keeping tax revenue around its historical level of about 18.3% of the economy, federal taxes would consume roughly one fourth of U.S. economic resources by mid-century.

At the same time, this tax hike masquerading as tax “reform” does not tackle the problem of our tax system’s excessive complexity. As former House Majority Leader Dick Armey noted in a Wall Street Journal opinion article last fall, “Compliance with the 60,000-page tax code costs Americans seven billion man-hours and over $140 billion in fees to accountants and consultants, all before a single check is cut to the government. While the AMT may be repealed by [Rangel’s] bill, the inefficiencies and burdens that keep Washington lobbyists employed full time remain.”

Given the option of a fair, simple, and transparent alternative to the current tax code, I believe that over time the majority of taxpayers would opt for the simpler system.

Although Congress did not vote on the “mother of all tax reform” bills, the House did pass a narrower measure in early November that borrowed elements from it. This legislation, which did not become law, resorted to permanent tax increases on businesses and individuals in order to delay for one year the full imposition of the AMT. This approach, like Chairman Rangel’s more sweeping proposal, is grounded in the faulty premise that the government is entitled to the growing tax revenues that are forecast to pour into the Treasury’s coffers as a result of the flawed way in which the AMT was written.

Raising taxes to stop an AMT tax increase merely creates problems in other areas, and this circular logic does nothing to strengthen America’s economy. Our taxpayers need a simpler tax code imbued with greater certainty that encourages investment and job creation, discourages constant congressional meddling, and keeps federal tax revenue as a share of the overall economy from expanding well past its historical level.

Letting Taxpayers Decide

Together with Congressman Jeb Hensarling (R-TX), John Campbell (R-CA), and Michele Bachmann (R-MN), I introduced legislation last fall to help us reach these goals and start us on the path toward a more user-friendly tax system that’s easy to comply with and doesn’t contain stealth tax hikes. This bill – H.R. 3818, the Taxpayer Choice Act – repeals the alternative minimum tax altogether and offers taxpayers the choice of a highly simplified alternative to the current individual income tax.

First, our proposal prohibits the imposition of the AMT on individual taxpayers in any taxable year after 2006 – heading off an $841 billion tax increase over the next 10 years that would otherwise spring from the automatic expansion of the AMT. Then our plan provides comprehensive reform, giving taxpayers the chance to select between two income tax systems: the current tax code with its various deductions and credits, or a new “simplified tax” that has just two income tax rates (10 percent and 25 percent).

Specifically, taxpayers who choose the simplified tax would pay 10 percent on taxable income up to $100,000 for joint filers ($50,000 for single filers) and 25 percent on taxable income above these amounts. A cost-of-living adjustment to these tax brackets is factored in each year. Under this simplified system, taxpayers would have no special tax preferences but would benefit from a generous standard deduction and personal exemption. The standard deduction is $25,000 for joint tax filers and $12,500 for single filers. The personal exemption is $3,500. For example, a family of four (in which the parents file taxes jointly) would have a standard deduction and personal exemptions that add up to $39,000 altogether.

On the other hand, if a taxpayer believes he will fare better under the current complicated tax code, then he or she can continue paying taxes through the existing system.

Under our legislation, taxpayers would need to make a choice within 10 years from the time that the simplified tax is established as to which tax structure they will use. To prevent people from gaming the system, year-by-year tax code switches are not permitted. After their initial selection, taxpayers would be allowed one changeover between the two tax systems over their lifespan. Beyond that, people could generally only switch tax systems if a major life event such as a marriage, divorce or death altered their filing status. Given the option of a fair, simple, and transparent alternative to the current tax code, I believe that over time the majority of taxpayers would opt for the simpler system.

The Taxpayer Choice Act is only one piece of what needs to be a larger solution to strengthening America’s economy and boosting our ability to compete globally. It applies solely to federal individual income taxes and, by itself, does not address needed reforms in the corporate tax, payroll tax and excise tax arenas. Nevertheless, it is a solid starting point for an overdue national debate on tax reform.

Without lasting reform, we face the prospect of continuing congressional squabbling over temporary, stop-gap measures to shield middle-income taxpayers from the looming AMT tax burden – injecting more uncertainty into an economy already shaken by other variables such as energy prices and the sub-prime mortgage crisis.

On the other hand, with the proposed reforms, we have the opportunity to repeal the AMT once and for all give taxpayers the choice of a simpler, more efficient tax system; and enable us to keep federal tax revenue as a share of gross domestic product close to its historical level instead of watching it rise steadily to nearly 24 percent of GDP by mid-century under the present path of tax law.

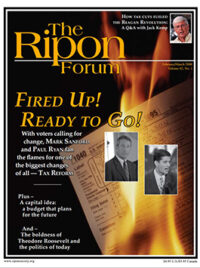

Paul Ryan represents the 1st District of Wisconsin in the U.S. House of Representatives. He is the Ranking Republican on the Budget Committee, and is a member of the Ways and Means Committee.