So far, fixing entitlement spending seems to be 2008’s stealth issue. Presidential candidates from both parties will, when asked directly, admit that spending on just three programs, Social Security, Medicare and Medicaid, is likely to move quickly from alarming to unsustainable. However, when asked what they would do about it, with just a few exceptions, the current presidential candidates quickly retreat into clichés.

This is somewhat understandable as there are no pleasant answers. Fixing entitlement spending without eliminating the rest of the federal government requires cutting benefits, raising taxes, or reorganizing the programs in some controversial and potentially scary way. In short, there is no solution that is guaranteed to bring a smile to a potential voter’s lips, much less one that will inspire him or her to write a big check. The old standby of solving a problem by cutting waste, fraud and abuse just will not work.

Rather than discussing candidates’ detailed positions on health care, this article will focus on both entitlements in general and Social Security in particular. Of the three big entitlement programs, Social Security is the easiest to fix in that it is simply a matter of increasing revenues or reducing benefits, and one does not have to focus on issues like medical technology, delivery systems, long-term care costs, etc. This approach to fixing Social Security regards adding personal accounts to Social Security as a way to make tax dollars go farther because contributions to the accounts grow faster than they would under the current system. However, all Social Security account plans that are funded out of current Social Security taxes also carry substantial transition costs as money that goes into them cannot be paid out in benefits.

Here are the facts according to the Congressional Budget Office: In 2005, spending on the three entitlement programs took up a total of 8.6% of this country’s Gross Domestic Product (GDP). Social Security amounted to 4.4% of GDP, Medicaid accounted for 1.5% and Medicare for 2.7%. Between now and 2050, that total of 8.6% of GDP spent on entitlements will reach an astonishing 19.9%. At that point, Social Security spending will reach 6.9% of GDP, Medicaid 4%, and Medicare 9%.

Given that the average level of federal taxation over the past 45 years is just over 18% of GDP, the only way to pay for entitlements in 2050 will be to either get rid of the rest of the federal government or to raise taxes to levels unheard of in American history. Neither option is exactly attractive as a campaign theme.

Who’s Saying What?

In this campaign, a couple of candidates are candid about entitlement spending. Former Alaska Democratic Sen. Mike Gravel happily discusses the size of the entitlement problem, and is unique among Democrats in proposing a fix for Social Security that includes a form of personal accounts. However, detail is lacking other than to propose that the current Social Security surpluses be invested in stocks and bonds, and Gravel’s support is so low that he is unlikely to have much influence one way or the other.

For the most part, Republicans acknowledge the problem with entitlement spending in general and Social Security in particular. They are uniformly opposed to raising taxes to solve the problem, and just as uniformly positive about adding some form of personal accounts to Social Security. Beyond that, specifics are very scarce. One can assume that talk about “difficult” choices is a code word for making benefit changes such as raising Social Security’s retirement age or focusing benefits on those who need them the most, but no one says so directly.

For the most part, Republicans acknowledge the problem with entitlement spending in general and Social Security in particular… Beyond that, specifics are very scarce.

Former Senator Fred Thompson openly discussed the problem of entitlement spending just after his official announcement, and pledged to make entitlement reform a cornerstone of his campaign. His official website says that, “In a few short years – not a generation from now – a fiscal tsunami that could imperil our security and economic prosperity will hit our nation and place an unfair burden of debt on our children and grandchildren.” Good start.

Unfortunately, the solution that he proposes is not very clear. It appears to center on, “Leading and making the hard choices necessary, to include cutting wasteful government spending, to safeguard our security, promote our prosperity, and protect our children and grandchildren from fiscal calamity.”

John McCain is equally candid about the problem. His website says that: “As president, John McCain is prepared to make the tough, fair, and responsible choices that honor our promises to current beneficiaries and to our children. Every year these decisions are delayed makes meeting this responsibility more difficult and expensive. Promises made to previous and current generations have placed the United States on an unsustainable budget pathway. Unchecked, Social Security, Medicaid and Medicare obligations will grow as large as the entire federal budget is now in just a few decades.” Very good start.

He is equally candid about solutions, stating in a speech to the Economic Club of New York that: “I have long supported supplementing the current Social Security system with personal accounts, but not as a substitute for addressing benefit promises that cannot be kept. People of good faith in both parties agree that we must make the hard decisions to restore solvency to these programs and that personal accounts can ease the impact of slower benefit growth. But, too often, we prefer to nurture our own ambitions rather than defend the public interest. It is long past time for our two parties to sit down together and fix our pressing entitlement problems.”

Mitt Romney is even more explicit about what he wants to do to fix Social Security. While his website has on it only a quote calling for the reform of entitlement programs, a link to an interview with his issues director, Glenn Hubbard, says that Romney, would look at “progressive” reforms of Social Security, including retirement age adjustment and indexing of benefits, where the reductions or modifications would not be “borne by the less well off.” This is an honest, direct approach.

Democrats are far less eager to talk about the need to fix entitlements, and are even less explicit about what they would do about the problem.

News reports state that Rudy Giuliani recognizes the problem with entitlement spending, but it is hard to find a mention of it on his website. Unlike McCain’s and Romney’s, his site has no search function, and his issues section links to either speech segments that mainly consist of slogans and platitudes or vague written policy statements. Giuliani is very explicit about how he wants to fix discretionary spending, but that level of candor does not seem to extend to entitlements.

Democrats are far less eager to talk about the need to fix entitlements, and are even less explicit about what they would do about the problem. Rather, Democrats discuss the individual entitlement programs. A search of websites found almost no mention of the need to fix entitlements, although they all had some level of health care reform, and most include a pledge to protect Social Security. Except for Gravel, Democrats are united against the “privatization” of Social Security, and while Republicans focus on making “difficult” decisions, a code word for changing benefits, most Democrats propose increasing taxes. With few exceptions, Democrats oppose changing Social Security benefits, even for wealthy Americans.

Senator Barack Obama, in an Iowa op-ed, proposed eliminating Social Security’s wage cap, which would require workers to pay payroll taxes on their entire income rather than just the first $97,000 as they do currently. In the same column, he also proposed to eliminate income taxes for retirees earning less than $50,000 annually. Since a large proportion of those income taxes are assessed on Social Security benefits, and were imposed in 1983 and 1993 to help fund both Social Security and Medicare, it is uncertain how much his combined plan would do to keep Social Security solvent. Obama also explicitly opposes both raising the retirement age and cutting benefits.

Former-Senator John Edwards has a more targeted Social Security tax increase in mind. Edwards would assess Social Security taxes on incomes of over $250,000, leaving them at the current level for those who earn less than that. Overall, he states that “financing of Social Security can only be solved by a package of reforms that has the support of both Democrats and Republicans.” He also says he “supports a successor to the Greenspan commission appointed in 1981, dedicated to finding a solution that is non-ideological, strongly bipartisan, and committed to the goals of ensuring every American can retire with dignity and extending the life of the Trust Fund.” This is probably the way that a successful Social Security reform plan will be developed, so he gets some credit here. Edwards also opposes cutting benefits or increasing the retirement age.

New York Senator Hillary Clinton also avoids speaking about entitlements. On Social Security, she is more explicit in what she opposes than what she supports. In addition to opposing personal accounts, Clinton also opposes raising payroll taxes or increasing the retirement age. Since if one takes raising taxes, changing benefits and introducing personal accounts off the table, nothing is left except hope and wishful thinking, there is a temptation to see the explicit promise to not raise payroll taxes as leaving room to supplement Social Security’s payroll tax with general revenues. However, this approach would do nothing to reduce the problem of entitlement spending.

Bill Richardson has an even less realistic program. For Social Security, he wants to protect the surplus, and encourage the economy to grow. He also wants to increase benefits by allowing women who take time out of the workforce to raise children or care for an ill family member to receive Social Security credit as if they had been employed. While there is value in this and it is the practice in many European countries, such a benefit increase would be extremely expensive, and does nothing to fix the spending problem. As for Richardson’s desire to solve Social Security’s problem by economic growth, the Social Security Administration has modeled such an approach. It found a 97.5 percent chance that growth would not solve Social Security’s problems.

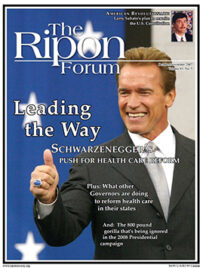

A current financial services commercial has a huge “800 pound gorilla” telling people that they need to make decisions about their financial futures. It is clear that those people would happily go to great lengths to ignore the gorilla. Entitlement spending plays the same role in the 2008 campaign. Some candidates, mainly Republican, at least acknowledge its presence, but virtually no one ventures an explicit solution.

At the very least, fixing the entitlement problem requires candidates to stop promising not to consider various approaches. Even if the final plan is developed by a commission similar to the 1983 one that wrote the last Social Security reform, pre-conditions that exclude certain items pretty much guarantee failure.

The American people deserve an honest discussion of the issue as part of campaign 2008. So far, the chance of that happening is very low.

David C. John is a Senior Research Fellow at the Thomas A. Roe Institute for Economic Policy Studies at the Heritage Foundation.