Throughout our country’s history, leaders have warned of the dangers of too much debt. As Thomas Jefferson famously wrote in 1816, to preserve independence, “we must not let our rulers load us with perpetual debt.”

And yet, not since Andrew Jackson in 1835 has a president succeeded in paying down the debt – in fact, much the opposite. Politicians of the modern age can rarely be bothered to attempt to deal with, as Sen. David Perdue pointed out in these pages, the fact that debt has now grown to more than $21 trillion and is “on track to grow by another $10 trillion over the next decade.”

While every child born today already inherits over $40,000 in debt, the next generation is on track to inherit a full-blown fiscal crisis. Forget the hope of programs like Social Security existing much longer – most of us know that won’t be around; we’ll be lucky if today’s profligacy avoids tanking the entire economy within a few decades.

In 2018, though, it seems that both parties have taken the sunny view of former Vice President Dick Cheney that “deficits don’t matter.”

But of course they do. The dryness of recent financial reports might obfuscate, but major programs are on track to run out of money within less than a decade, with no serious reform in sight. Congress couldn’t even pass the drop-in-the-bucket rescissions package President Trump presented them last month.

Just because government can do something doesn’t mean it should.

Lawmakers kick the can down the road because they can do so without consequence. Unlike a tax increase, an increase in the national debt doesn’t immediately affect anyone’s paycheck. And who among us instinctively attributes higher interest rates or lower income growth to marginal rates of spending and growing government?

The issues are complicated.

What’s more, current approaches simply aren’t working. There are the constitutional arguments: just because government can do something doesn’t mean it should. There are the fiscal sustainability arguments: current programs aren’t affordable and we don’t have the money to pay for future promises. And there are the ideological arguments: the private sector is more efficient and shifting resources toward government makes us all worse off.

While each of these lines of reasoning has appeal to specific segments of the population, their ineffectiveness at attracting support from the broader public is obvious given the reality of our fiscal situation.

At the core of our current failure is a lack of specific accountability: even if you agree that the debt is bad, who is to blame?

Today, there are many organizations that work to elect new Members of Congress, with the idea that electing “better” people – however defined – will bring different results. But if it is not possible to know who is responsible for current outcomes, and if elected officials operate in a system that fails to encourage confrontation with difficult fiscal decisions, then simply electing new people is unlikely to result in different outcomes.

There are only two options for better controlling the nation’s finances, and they must work hand-in-hand – better rules and better accountability.

As to the former, we have a fiscal process in Washington in which appropriations bills rarely are debated or considered alone, budgets are rarely passed, and the debt limit – the sole theoretical check on rising debt – is raised almost by habit.

Many ideas exist for better fiscal rules, but procedural changes alone are also not enough.

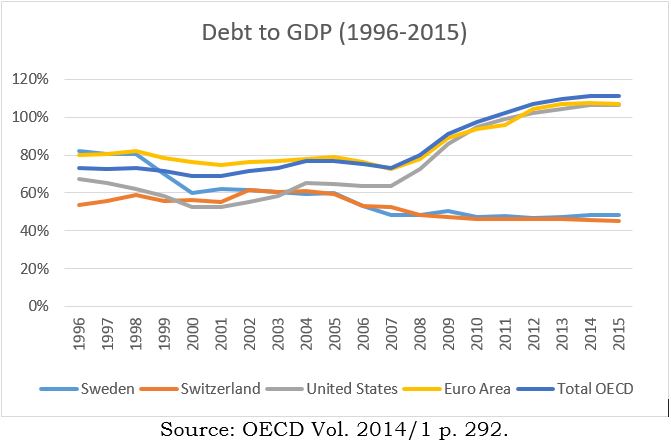

Without a structure to guide policymakers toward more desirable outcomes, electing new people alone doesn’t work. Countries with a check on their expenditures – Switzerland with its “debt brake” and Sweden with its rules that forced cuts to its overly generous pension programs – displayed far lower levels of debt in the wake of the 2008-2009 financial crisis and show the promise of better rules.

Many ideas exist for better fiscal rules, but procedural changes alone are also not enough. When Members can pass the blame onto others or the body as a whole, violating rules – at least when passed statutorily – has to come with accountability for individual Members.

Fortunately, it is actually possible to track how much individual members of Congress are voting to add to the national debt. The most important piece of his calculation is spending, and my organization’s SpendingTracker.org cross-references – for the first time – official fiscal estimates from the Congressional Budget Office with individual vote records.

Spending Tracker represents a key way to record what every Member of Congress is doing – and to hold them accountable. Parents of today will no longer have to wonder which politicians are burdening their children and grandchildren with inescapable debt – they will know as it happens.

Consider, as an analogy, the current world of financial prognostication, in which commentators offer various predictions as to what will happen to home prices or which way the stock market will move. When hearing these predictions on television, it’s impossible to judge the likelihood of them coming true without knowing the predictor’s past record of success.

In much the same way, Members of Congress are currently free to tell voters and the general public that they support balanced budgets, fiscal responsibility, and smaller government. And while we may remember a specific instance here or there to the contrary, it has historically not been possible to compare one Member’s record to another. SpendingTracker.org changes this by opening up the impact of Members’ votes not just on spending taking place today, but also the impact their votes will have on the debt tomorrow.

The accountability of new technology combined with time-tested reforms offers hope that the United States will not keep sliding steadily into the realm of fiscal crisis. There’s still time left to right the ship – and if Congress cannot get its act together, creative solutions from an engaged public are our best bet.

Jonathan Bydlak is a fiscal policy expert; he is the founder and president of the Coalition to Reduce Spending and the Institute for Spending Reform, which spearhead SpendingTracker.org.