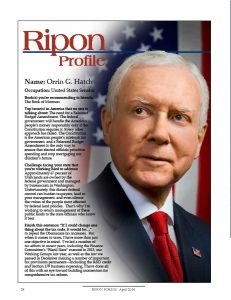

Name: Orrin G. Hatch

Occupation: United States Senator

Occupation: United States Senator

Book(s) you’re recommending to friends: The Book of Mormon

Top issue(s) in America that no one is talking about: The need for a Balanced Budget Amendment. The federal government will handle the American people’s money responsibly only if the Constitution requires it. Every other approach has failed. The Constitution is the American people’s rulebook for government, and a Balanced Budget Amendment is the only way to ensure that elected officials prioritize spending and stop mortgaging our children’s future.

Challenge facing your state that you’re working hard to address:

Approximately 67 percent of Utah lands are owned by the federal government and managed by bureaucrats in Washington. Unfortunately, this distant federal control can burden taxpayers, lead to poor management, and even silence the voices of the people most affected by federal land policies. That’s why I’m

working to return management of these public lands to the state officials who know it best.

Finish this sentence: “If I could change one thing about the tax code, it would be…”…to repeal the Obamacare tax increases. But when it comes to taxes, I have more than just one objective in mind. I’ve led a number of tax efforts in recent years, including the Finance Committee’s “Blank Slate” exercise in 2013, our Working Groups last year, as well as the law we passed in December making a number of important tax provisions permanent—including the R&D credit and Section 179 business expensing. I have done all of this with an eye toward building momentum for comprehensive tax reform.