Figuring out how to grow the economy on a sustained basis is one of the more urgent economic challenges of the moment.

I would also include: dealing with growing income inequality; getting our national debt under control; and, developing larger structural reforms to modernize our capitalist system to reflect the new “tech & data economy.”

But, the more economic growth, the easier the other pieces will be. We should then be engaged in an honest and disciplined attempt to evaluate how much growth is realistic, and the best ways to achieve it.

But instead of working on a comprehensive growth plan filled with ideas like productive aging, developing a pro-growth immigration plan, finding smarter tax bases and cleaning up our tax breaks, and shifting towards an investment-based budget, our policymakers are intently focused on pursuing ‘free lunch economics.’

Adherents of free lunch economics point to things they already wanted to do. They also make exaggerated claims about the growth they are likely to create. Finally, they argue that actually paying for these policies is too hard, is unnecessary, and is anti-growth. They are like credit-card junkies who refuse to face hard truths. Well, with the national debt topping $22 trillion for the first time in history, it’s a good time to not only review some of the arguments that free lunch adherents make, but present them with some cold, hard facts they cannot refute.

Even if we are successful in implementing a comprehensive plan to grow the economy, it is not going to be enough to grow our way out of our debt problems.

Free Lunch Argument #1: “Deficits don’t matter because interest rates are so low, and will stay low” — The fact is that while low rates reduce the burden of borrowing, they are nowhere near low enough to bring the debt to sustainable levels. Our current plan is to borrow another $12.5 trillion over the next decade. This is on top of a debt-to-GDP ratio that is the highest this country has ever seen other than right after World War II. Our interest payments are projected to grow from $383 billion this year (1.8% of GDP) to $928 billion (3.0% of GDP) in a decade. In fact, interest payments are the fastest growing part of the budget. So yes, our interest rates are currently quite low — though we have no idea if they will stay low; and yes, we should still worry.

Free Lunch Argument #2: “Tax cuts will pay for themselves.” This of course was the argument that was used to justify massive tax cuts rather than the tax reform that would have been more prudent. The tax cuts will add roughly $2 trillion to the debt over the decade, and it was argued that they only (sounds small, but is actually quite large) needed to increase growth by 0.4% per year to pay for themselves. Credible estimates project that they will increase growth by roughly 0.1%.

It cannot be said enough: tax cuts do not pay for themselves. They do generally grow the economy, but not by nearly enough to cover the lost revenues.

Free Lunch Argument #3: “Some things — actually most things — are just too important to pay for now.” We have grown accustomed to the claim that certain priorities are too darn important to pay for. Priorities like: national emergencies; raising the discretionary spending caps for defense and other domestic spending; stimulus spending during recessions (which could and should be offset over the long-term). I can promise you there’s about to be a long list of new important spending priorities with a much, much shorter list of how to pay for them. But the only reason not to offset the cost for these priorities is because it’s politically difficult. At this point in the business cycle, where stimulus isn’t needed, not paying for new priorities is just saying you would rather have someone else pick up the tab. That someone else is our children and grandchildren.

Here’s the reality: growth is likely to be significantly lower going forward than it has been in the past. Demographics are now working against us, and labor market growth will be much slower given the aging of the population. The lower estimates we see from all major forecasters of long-term growth rates of around 2% reflect that demographic reality.

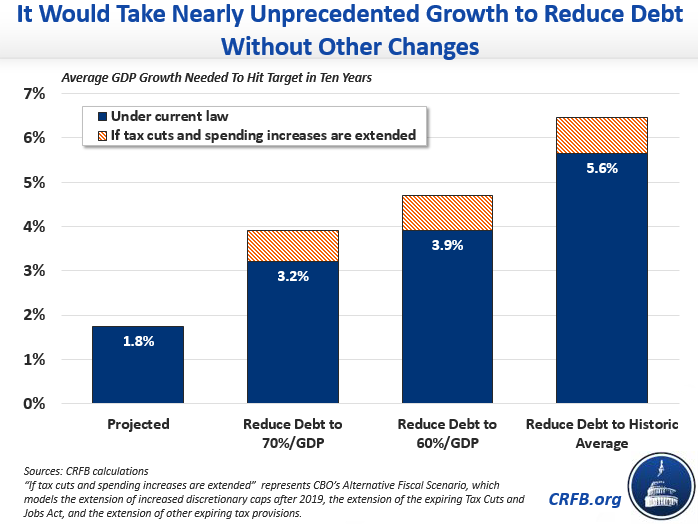

It would take sustained growth of 3.2% to stabilize the debt at 70% of GDP … It would require growth of 5.6% to bring debt relative to GDP back to historical averages over ten years.

A really smart policy agenda could boost this rate by a few tenths of a percentage point. Talk of permanently sustained growth rates of 3%, 4% and more are just not based in reality.

So the second reality we face is that even if we are successful in implementing a comprehensive plan to grow the economy, it is not going to be enough to grow our way out of our debt problems. In fact, it is the reverse – if we enact smart policies to reduce our debt, that will help with longer-term growth.

It would take sustained growth of 3.2% to stabilize the debt at 70% of GDP. Or growth of 3.9% to stabilize at a more desirable 60%. It would require growth of 5.6% to bring debt relative to GDP back to historical averages over ten years. These numbers assume we don’t extend the recent tax cuts and spending increases. If we do, they would all need to be about 0.8 points higher.

A realistic plan to bring down our debt trajectory will include securing Social Security and other trust funds headed toward insolvency, controlling the growth of healthcare costs, increasing revenue, and reducing spending — along with hopefully higher levels of growth. Those are what are known as hard choices, necessary tradeoffs, and budgeting.

We should do what we can to grow the economy. But the growth fairy is not going to be the answer to our glaring fiscal challenges. That will require the kind of leadership that we have not seen in recent years, but hopefully we will see again soon.

Maya MacGuineas is the President of the Committee for a Responsible Federal Budget as well as the President of the Campaign to Fix the Debt.

________________________________