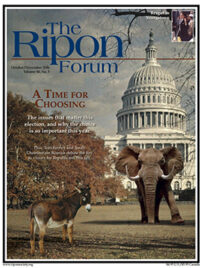

This year’s mid-term elections are already taking on an aura approaching that of a Presidential election. Typically, mid-terms are marked by low voter turn-out and modest losses for the party of the incumbent President. But these are not typical times. With control of both houses of Congress up for grabs, November’s elections are generating an unusual amount of interest – not only among the two parties’ activist bases, but among the American people in general.

And well they should. For, in terms of keeping our economy prosperous and productive, the stakes couldn’t be higher. The result of these elections will determine whether our nation continues to pursue sound and proven policies that promote economic growth and job creation, or whether we revert to the kind of crushing taxation that frustrates the entrepreneurial spirit and further burdens working families.

In the 2002 mid-terms, when security concerns were uppermost in the public consciousness one year after 9/11, Republicans bucked the historical trend and increased their Congressional majority. I believe that the strength and resolve that the Bush Administration and Congressional Republicans have demonstrated in the war on terrorism these past five years will continue to be a defining theme of the 2006 elections and will ultimately help our party to maintain control of the House and the Senate.

I am concerned, however, about the enormous implications that November’s outcome will have on our tax and fiscal policies. Naturally, the Democrats will try to obscure their intentions in this area. If they were up-front about their tax-and-spend agenda, voters would be driven into the arms of Republicans by the millions. Furthermore, I don’t believe we can count on the mainstream media to provide a complete and accurate description of how the low-tax policies pursued by a Republican Congress and Administration have generated impressive and sustained economic gains, kept unemployment comparatively low by recent historical standards, and helped us to recover from a recession, inflated stock prices, corporate scandals, environmental disasters and an unprecedented terrorist attack on our nation.

Therefore, it falls to Republican candidates, challengers and incumbents alike, to run on a platform of keeping taxes low, and to remind voters of the positive effects that have resulted from the tax relief for individuals and small businesses enacted every year since the Republicans took over control in Congress in 1994.

With a new Republican Administration joining forces with a Republican Congress after the 2000 elections, we got to work on fixing a federal tax code that was plainly dysfunctional and needlessly complex, one that punished hard work and thrift, discouraged savings and investment, hindered the international competitiveness of our companies, and perversely encouraged abusive tax avoidance schemes. As a member of the House Ways and Means Committee, I was proud to play a role in passing the most sweeping program of tax relief and reform in a generation. Among other achievements, we lowered individual rates for all Americans who pay income taxes, doubled the child tax credit, reduced the marriage penalty, and phased out the death tax that penalizes family-owned small businesses and farms.

We built on the reforms of 2001 by passing the Jobs and Growth Act of 2003, reducing the tax rates on capital gains and dividend income to encourage saving and investment. This law quadrupled small business expensing to allow entrepreneurs to deduct the first $100,000 of investment from their taxes.

Given our successful record, Republicans need to emphasize the importance of making this tax relief permanent, so that individuals and businesses can plan for the future with predictability and confidence. Lest we forget, all the tax relief enacted over the past five years, including the relief for small businesses and families, as well as the phasing out of the death tax, is scheduled to expire over the coming years – unless Congress acts to make these cuts permanent. As Senate Majority Leader Bill Frist recently pointed out, taxes for a family of four with an income of $64,000 will go up 58 percent if those tax cuts are not made permanent.

The result of these elections will determine whether our nation continues to pursue sound and proven policies that promote economic growth and job creation, or whether we revert to the kind of crushing taxation that frustrates the entrepreneurial spirit and further burdens working families.

Since Democrats will undoubtedly try to say Republicans are in favor of hurting senior citizens and working families, Republicans must point out that seven million seniors who rely on dividend income are benefiting from the tax relief we provided, while the overall tax burden on working Americans is the lowest it has been in nearly 40 years. And, faced with Democrats’ attempts to frame the issue in terms of class warfare and “tax breaks for the rich,” Republicans must consistently and firmly explain that raising taxes on business owners and investors will hurt economic growth and job creation, with middle class Americans suffering in the long run.

But it is not enough simply to call for continuity of effective Republican policies and demonstrate the deleterious effects that the Democrats’ inevitable tax hikes will create, as important as those messages are. Republicans must offer the voters a forward-looking agenda that builds on our past successes. Reforming the tax code must be one of the key points in this autumn’s national debate. The taxpayers deserve, and our future economic prosperity demands, a simpler, fairer, more pro-growth system that rewards hard work and promotes greater ownership. Our tax policies should do more to encourage charitable giving by individuals and private organizations, whose generosity has shown America a good nation as well as a great one. We must continue to offer incentives for Americans to increase their savings and investment in private markets to build assets for retirement and life’s other needs.

At the same time, Republicans must stand for restraining spending by the Federal Government. Since the Reagan era, we have seen that the enhanced economic activity and job creation resulting from lower taxes on businesses ultimately brings in more revenues for the government. But conservatives must make the case that fiscal responsibility transcends the narrow goal of keeping the federal coffers full.

Lest we forget, all the tax relief enacted over the past five years, including the relief for small businesses and families, as well as the phasing out of the death tax, is scheduled to expire over the coming years – unless Congress acts to make these cuts permanent.

Tax relief and spending are not of the same value. Certain green eyeshade, zero-sum analyses have created the mistaken impression that cutting taxes and increasing spending have an equal effect on the federal budget and the larger economy, but they do not. Tax cuts allow families and business owners to keep more of their money. New spending results in the government’s controlling an increasingly large share of the economy. Conservatives must continuously rebut the arguments about the “cost” of tax cuts by demonstrating the true costs of ever higher taxes and spending. And Republican candidates must engage the voters in a discussion of how to limit spending and the growth of government through such concrete measures as a cap on discretionary spending, a line-item veto on new appropriations and mandatory spending, procedural changes in Congress, such as a requirement for a super-majority of 60 percent to raise taxes, and creation of a “Sunset Commission” to recommend to Congress which programs could be consolidated, restructured or eliminated outright with a focus on producing tangible results instead of perpetuating bureaucracies.

November 7 is indeed a time for choosing. In the weeks leading up to that day, Republicans can confound the pundits and the pollsters by reminding voters of what our low-tax agenda has accomplished, the benefits that this governing philosophy will continue to provide, and the danger of reverting to the tax-and-spend policies that our opponents will inevitably pursue if they gain control of Congress.

Jennifer Dunn is a former Representative from Washington and served on the House Ways and Means Committee and in House Leadership. She is currently with the international law firm of DLA Piper.