Had this presidential cycle not degenerated into a clash of personalities, we might have been treated to one of the greatest debates over the direction of tax policy of any presidential election.

Had this presidential cycle not degenerated into a clash of personalities, we might have been treated to one of the greatest debates over the direction of tax policy of any presidential election.

Starting with the primaries, there has never been an election in which so many candidates produced such detailed and well-vetted tax reform plans. This is especially true on the Republican side of the aisle, where my Tax Foundation team was asked to score at least a dozen tax plans for candidates. We scored four variations of a Flat Tax, two different plans containing a value-added tax (or “business flat tax”), a variant of what’s known as the Bradford X-Tax, and a number of plans that blended components of these other plans.

But now we are down to two candidates, neither of whom has a plan that moves us toward tax reform. Hillary Clinton’s plan would make the tax code more complicated while shifting even more of the tax burden on those she considers “rich.” Donald Trump is offering a huge tax cut plan for individuals and businesses, but he falls short of implementing the kinds of reforms that reshape the system.

Now we are down to two candidates, neither of whom has a plan that moves us toward tax reform.

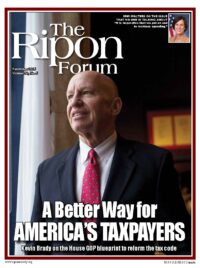

The good news is that no matter who wins on November 8, all tax bills start in the House of Representatives, and Speaker Paul Ryan and Ways and Means Chairman Kevin Brady have proposed a tax reform “blueprint” that could provide the basis for a serious bipartisan agreement for comprehensive tax reform in 2017.

Where the two candidates stand

Simply put, Clinton’s plan would be a boon to tax lawyers for decades to come. Her plan would significantly raise taxes on high-income taxpayers by enacting a 30 percent minimum tax called the “Buffett Rule,” a cap on itemized deductions, and a 4 percent “surtax” on incomes above $5 million. Her plan would also significantly increase the estate tax, especially on very large estates. She would balance these large tax hikes by doubling the tax credit for families with small children and allowing expanded expensing for small businesses. None of this represents a simplification of the tax code.

Tax Foundation economists estimate that her plan would increase federal revenues by $1.4 trillion over the next decade, not taking into account the impact on economic growth. Under Clinton’s plan, the economic effects of the higher taxes would decrease the long-run level of GDP by 2.6 percent. This would reduce long-run wages by 2 percent and employment by 700,000 full-time equivalent jobs. Taking into account the smaller economy, we found that her plan would raise “just” $663 billion over the next decade, a fraction of the money needed to fund her new spending programs.

Tax Foundation economists estimate that her plan would increase federal revenues by $1.4 trillion over the next decade, not taking into account the impact on economic growth. Under Clinton’s plan, the economic effects of the higher taxes would decrease the long-run level of GDP by 2.6 percent. This would reduce long-run wages by 2 percent and employment by 700,000 full-time equivalent jobs. Taking into account the smaller economy, we found that her plan would raise “just” $663 billion over the next decade, a fraction of the money needed to fund her new spending programs.

Trump’s tax plan significantly cuts taxes, but mostly steers clear of the more difficult task of eliminating the loopholes and sacred cows in the tax code. His plan would cut the individual income tax for most taxpayers by cutting marginal rates and expanding the standard deduction. He would cut corporate income taxes by reducing the corporate income tax rate from 35 percent to 15 percent and allowing businesses to choose between a deduction for net interest expense and the full expensing of capital investments. His plan would also introduce an expensive new credit for childcare costs.

We estimated that his plan would cut tax revenue by between $5.9 trillion and $4.4 trillion over the next decade, depending on how his plan treats “pass-through” businesses. However, because the plan would significantly reduce marginal tax rates on work, saving, and investment, it would boost the long-run size of GDP by between 6.9 percent and 8.2 percent.

The larger economy would boost wages between 5.4 and 6.3 percent, and create as many as 2 million full-time equivalent jobs. Of course, the larger economy would end up broadening the tax base and reduce the ultimate cost of his plan. We estimate that his plan would reduce revenues by between $3.9 trillion and $2.6 trillion on a dynamic basis.

What House Republicans would do

While the Trump plan sounds good to many, the House GOP blueprint represents a real down payment on fundamental tax reform. It greatly simplifies the tax code for individual taxpayers while lowering rates across the board. The big economic benefits come from the business side, where the plan cuts the corporate tax rate from 35 percent to 20 percent and makes major changes to our international tax rules.

The House GOP blueprint represents a real down payment on fundamental tax reform.

In the parlance of tax nerds, the GOP blueprint transforms our system into a destination-based cash-flow tax system. The first step is allowing businesses to write off the cost of their investments immediately, which will ultimately lead to more investment, higher productivity, and 7.7 percent higher wages by our estimate.

The new system will be border-adjusted. This means that domestic and imported goods will be put on a level playing field, and our exports won’t be taxed at all by Uncle Sam.

We estimate that the blueprint would boost GDP by 9.1 percent over the long term and create 1.7 million new jobs. With all that new economic growth, the plan comes pretty close to paying for itself over the next decade. Just as importantly, the plan will make the U.S. one of the most attractive places to do business in and do business from.

Tax reform must be a top tier issue for the new president and Congress. Although tax reform got swamped by the debate over personalities in the presidential campaign, Speaker Ryan and Chairman Brady have given us hope that 2017 can be the year America gets the tax reform plan it has deserved for more than a generation.

Scott A. Hodge is President of the Tax Foundation, a nonpartisan tax policy think tank in Washington, D.C.