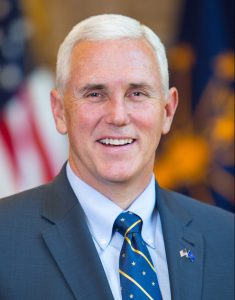

In a very unconventional campaign, Mike Pence was a very conventional choice for vice president. He is the governor of Indiana and served for over a decade in Congress. He is also a member in good standing of the “establishment” wing of the Republican Party with a long history of supporting tax cuts, and particularly business tax cuts. His approach has won him kudos from many Republican leaders in 2016, but would it boost his 2020 prospects?

In a very unconventional campaign, Mike Pence was a very conventional choice for vice president. He is the governor of Indiana and served for over a decade in Congress. He is also a member in good standing of the “establishment” wing of the Republican Party with a long history of supporting tax cuts, and particularly business tax cuts. His approach has won him kudos from many Republican leaders in 2016, but would it boost his 2020 prospects?

On the day that Donald Trump announced Pence as his running mate, House Speaker Paul Ryan said he could “think of no better choice for our vice presidential candidate.” He added that Pence’s tax record as governor “put his principles into practice.” Indeed, Pence successfully cut individual income taxes, corporate income taxes, personal property taxes, and completely eliminated the state’s inheritance tax in just three years. He continuously championed his tax cuts as a way to make Indiana more competitive than its neighbors in attracting businesses and growing the state’s economy.

When Pence took office, Indiana’s 3.4 percent flat individual income tax rate was already the second-lowest in the nation. Still, in his first state of the state address, Pence pitched a 10 percent cut as a way to “unleash half a billion dollars” into Indiana’s private economy. The Republican-controlled legislature eventually passed a 5 percent reduction, bringing Indiana’s tax rate down to 3.23 percent.

Pence successfully cut individual income taxes, corporate income taxes, personal property taxes, and completely eliminated the state’s inheritance tax in just three years.

The same legislation also killed Indiana’s inheritance tax, which affected estate transfers greater than $250,000. It was already scheduled to phase-out by 2022, but Pence and the legislature repealed the tax for the estates of all persons deceased after 2012.

Pence then proposed big business tax cuts in 2014. He eventually signed legislation to gradually lower Indiana’s corporate income tax rate from 6.5 percent to 4.9 percent by 2021, and allow Indiana counties to trim personal property taxes for businesses – although this was a smaller change than the governor’s proposed repeal.

Did Pence’s tax cuts work? He often tells a success story — but it’s incomplete.

Indiana’s unemployment rate has fallen from 8.4 percent when he took office in January 2013 to 4.5 percent today. But the national jobless rate fell from 8.3 percent to 5.0 percent over the same period. Furthermore, Indiana’s 3.9 percentage point drop is comparable to declines in neighboring states such as Michigan (-4.3 points), Illinois (-3.7 points), Kentucky (-3.1 points), and Ohio (-2.7 points).

It’s a similar story with the state’s overall economic growth. Since Pence took office in 2013, Indiana grew at roughly the same pace as the national economy and fell between the best (Ohio) and worst (Kentucky) among its regional competitors.

Ultimately, any attempt to grade a governor on his state’s economic performance is precarious because a state’s economy depends on a lot more than what the governor does — particularly over three years. Would Pence’s policies still have delivered good times if the national economy stumbled? Long-term studies (see “The Relationship Between Taxes and Growth at the State Level,” Urban Institute 2015) show that tax cuts don’t guarantee state economic growth.

Indiana’s unemployment rate has fallen from 8.4 percent when Pence took office in January 2013 to 4.5 percent today.

But you can judge governors on what they do. And like other recent Republican governors, Pence felt that individual income and corporate tax cuts were the best way to boost his state’s economy — by keeping and recruiting businesses. He did not lower Indiana’s 7 percent sales tax, increase its relatively low earned income tax credit, or make other changes that might have more directly benefited low- and middle-income Indiana families.

If the polls are right and Trump loses on November 8th, Pence could become a front-runner for 2020 GOP nomination. But would his tax record still fit the GOP primary playbook?

The Tax Policy Center analyzed the tax plans of four 2016 Republican candidates: Trump, Jeb Bush, Marco Rubio, and Ted Cruz. All proposed huge tax cuts (with unprecedented costs) aimed at boosting economic growth. But there were also new spins on the old tax cut formula. Trump proposed a huge increase to the standard deduction (notably scaled back in his second plan) that would have significantly increased the number of households that do not pay income taxes. Rubio proposed a larger child tax credit aimed at middle-income families. And Cruz proposed a tea-party favored overhaul: a major shift from taxing income to taxing consumption.

In contrast, Pence’s record as governor is old-school Republican. In fact, it looks most like the blueprint put forward by Ryan and the House GOP leadership. Promoting his solid record in Indiana of cutting taxes certainly won’t cost Pence votes in a GOP primary. But are tax cuts for businesses and the wealthy pitched as a way to jump-start the economy enough for an evolving Republican Party electorate?

That, as with so many other questions facing the party, remains to be seen. But one thing is certain – when it comes to tax relief, Mike Pence has a proven record to run on, and a list of real accomplishments he can call his own.

Richard Auxier is a research associate in the Urban-Brookings Tax Policy Center at the Urban Institute.